Finance • 31st Oct, 25

CRÚ Food & Wine Bar Eyes National Growth

Simon Bozas, cofounder of family office Mezas Capital, could see the potential in CRÚ Food & Wine Bar. That vision turned into…

7160 North Dallas Parkway, STE 380, Plano TX 75024

YOUR ABSOLUTE CAPITAL SOLUTION

YOUR ABSOLUTE CAPITAL SOLUTION

Mezas Capital Group is an investment and advisory firm that started operations in 2013. We aim to improve the performance of small and medium size enterprises, while bringing strong returns to its investors.

Careful sourcing and diligent advising of clients, achieved through the relationships developed over many years, and the proven experience of the team in this industry

Complete alignment of interests between Mezas and its investors, supported by the fact that the group invests a substantial amount of its own capital in every equity transaction it undertakes

Holistic approach to investing, through a continuous commitment of actively supporting the growth of its companies, with either capital or expertise

Mezas’ excellent track record, with over $180 million provided in debt and equity funding to small and medium size businesses

Microinfo Inc

Zimat IT

Zodiac Solutions

Polovora

Glasshive

Dataken

Validsoft

Rent-a-Center

2.0 Taco & Tequila Bar

Blue Mesa Tacos

Alive Yoga

Origin Bank

Encore Bank

BTH Bank

Total Care PPE

Future Commerce

Motorhead Hat Co

CRU Food & Wine Bar

Nowitzki Restaurant

Turco 35 Brews & Bites

Southwest Spirits

Strut Health

Dallas Sidekicks

Rajasthan Royals

Barbados Royals

Puerto Rico Blue Knights

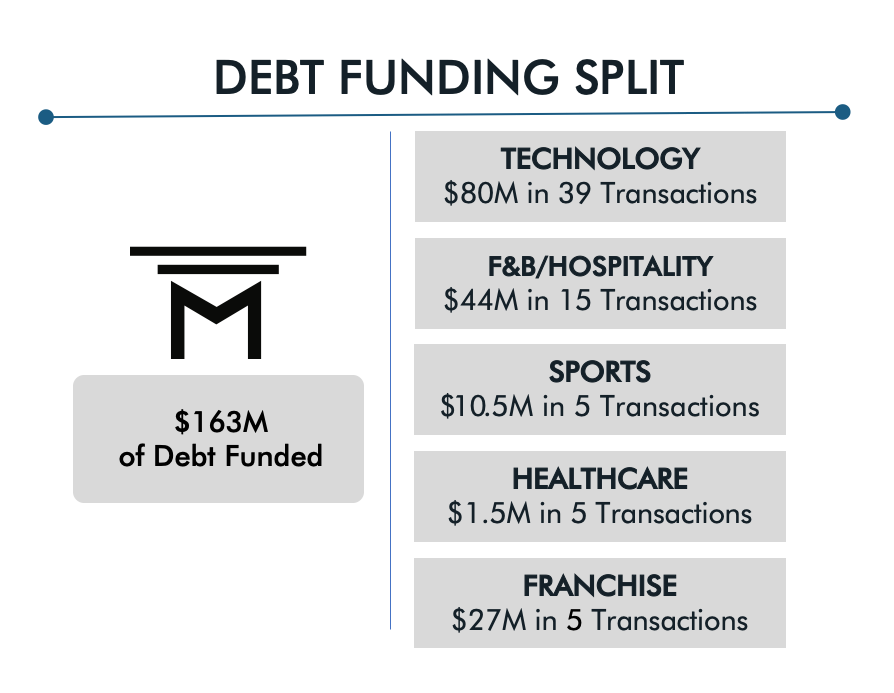

Mezas has an appetite for debt deals. Mezas has a track record of successful investments and strong network relationships with both financial institutions & the business community

Given its experience and track record, a large numbers of potential deals are presented to the group, both from financial institutions and directly from potential clients

The end result is the ability to select only the most solid investment opportunities, which in turn will deliver strong results to investors and create lasting partnerships with our clients and financial institutions

With more than 90 years of experience, and an excellent investment track record, the team at Mezas has developed a large business network and earned the trust of investors

Additionally, a considerable part of the funds raised in each transaction is applied by Mezas using its own funds

This complete alignment of interests between Mezas and its investors is one of the key factors that explains its superior capital raise capabilities

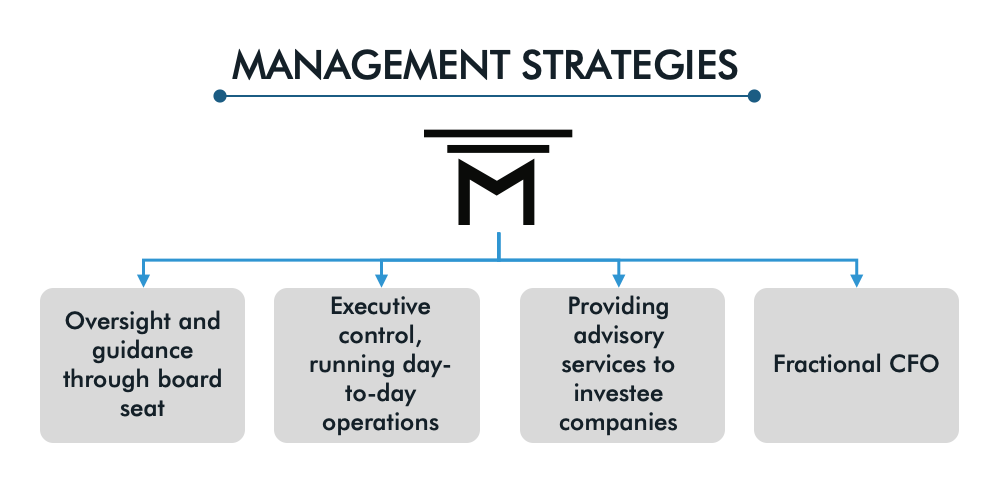

Mezas provides active guidance to its investee companies stimulating their growth while maximizing returns for investors

For some companies the Mezas team will take an oversight and general guidance role by having a presence in the executive board

In other cases, the Mezas team will have a more active role in the company’s day to day operations, either by taking a full time management role, or by providing some of its advisory services, such as Fractional CFO

Mezas framework can help companies evaluate their potential liquidity. We put a unique model together to meet our clients needs

Using its vast expertise and the relationships and ownership Mezas has established with lenders and investors, Mezas is able to support companies in obtaining strategic capital advantages in different areas

Services can include a range of strategic areas, such as structuring of financing packages for acquisitions, finding providers of growth capital to businesses, and restructuring of existing debt

The group is able to complete end-to-end deals, supporting both buyers and sellers with services that include valuation, target/buyer sourcing, due diligence and integration planning

Mezas mitigates challenges faced by companies when it comes to sourcing and optimizing the allocation of both debt and equity capital

Mezas provides advisory services for mergers and acquisitions, either to accelerate growth, take advantage of synergies, or to reduce competition in the market

Mezas provides exceptional financial expertise to small and medium sized companies that wish to grow their business but cannot afford the cost of hiring a full time CFO

With its Fractional CFO services, Mezas provides clients with a seasoned CFO with the necessary skills and expertise on a part time basis

The main areas of support are financial planning and analysis, guidance and oversight of financial budgeting and reporting, and leadership of the clients’ finance and accounting teams

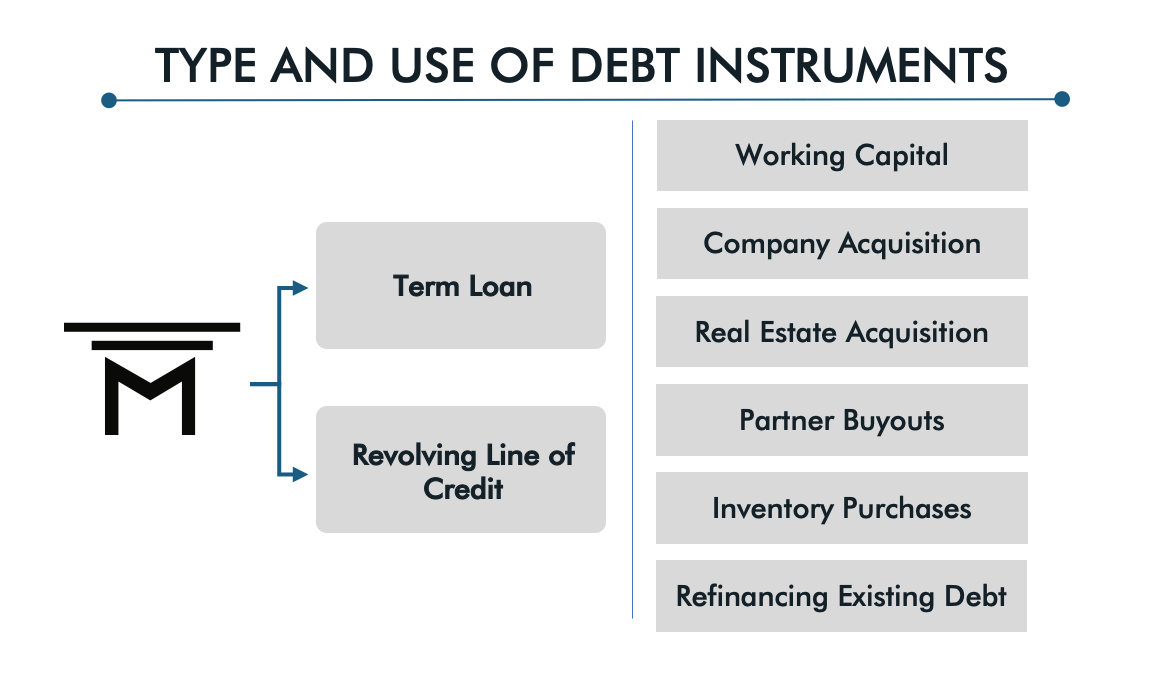

Thanks to an extensive network of relationships developed with regional banks and lenders, Mezas Capital Group is able to provide its clients with varied debt solutions and the most competitive terms.

The group is sector agnostic in its debt placement activities with a wide variety of industries.

Debt placement is structured as term loans and revolving lines of credit, with the provided capital being used for:

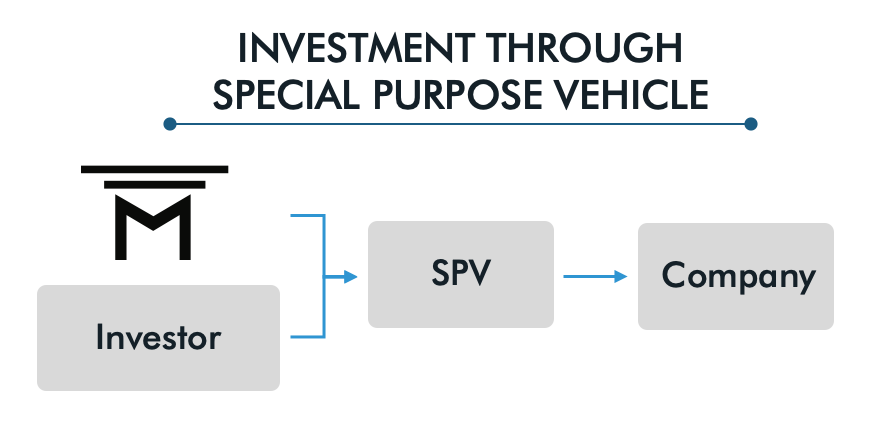

Unlike what is usually seen in the alternative investments sector, the group does not have a fund with committed capital to invest at its own discretion. Mezas’ transactions usually observe the following guidelines:

The group is sector agnostic in its debt placement activities with a wide variety of industries.

Depending on the type of transaction and the capabilities required, Mezas will have one of the following approaches:

For its debt placements, Mezas looks for opportunities that fall within the following criteria:

Mezas looks for investments that meet the following criteria:

Simon Bozas

Imran Memon

eduardo NájeRa

Tina Rincon

hektor Garza

Wes Wolfe

Finance • 31st Oct, 25

Simon Bozas, cofounder of family office Mezas Capital, could see the potential in CRÚ Food & Wine Bar. That vision turned into…

Finance • 11th Sep, 25

Teresa Gubbins CultureMap Dallas Sep 8, 2025

Longtime Dallas wine bar chain has entered a new era: Cru Food & Wine…

Finance • 10th Aug, 23

WFAA, Paul Livengood, August 8, 2023

DALLAS — A new Dirk Nowitzki-themed bar and restaurant has officially opened in Terminal C of DFW Airport,…